Every summer when we see Vacation Confidence Index research reports, it gives us pause. What’s the value of travel? How much pay are people willing to sacrifice to get more time off? If time and money are not the impediments to travel, what holds people back?

Details from the reports are below. For fun, I like to come up with alternate headlines that represent the statistics in a different, but still accurate light.

For many people, it’s simply the hassles of planning travel and dealing with potential problems that turns them back from seeing more of the world. That’s why we like to cover our favorite travel tips and advice, travel gear, and travel apps that make our peripatetic lives easier. We’ve also covered various aspects of travel insurance, and why we finally decided to go with our annual plan. We don’t go anywhere without it.

For a complete picture of travel insurance options, see our post, Travel Insurance Basics and New Coverage Options.

Note: This post and other posts on TravelPast50.com may contain paid or affiliate advertising links.

SmartBenefits Proactive Claim Payments for Flight Delays

The latest product by Allianz Global Assistance is the SmartBenefit program, which is available with the OneTrip Prime or OneTrip Premier plans from Allianz Travel. Basically, what it does is offer a proactive payment–potentially within minutes–for a covered flight delay, without having to file a claim. That’s the sort of time-saving and hassle-free transaction that can change one’s whole perception of a vacation experience.

These quick automatic claim benefits are possible because flights are monitored by Allianz. A covered delay pays $100 per person per day, and the payment can be received by debit card (instantly), direct deposit, or check.

If the customer’s covered expenses during a delay exceed the $100, they still can submit a claim with receipt for the remaining expenses. But the proactive payment–particularly to a debit card–means you can access funds while you are delayed, and maybe buy yourself a meal.

The flight delays we’re talking about are three hours for the OneTrip Premiere plan, and five hours for the Prime plan. But as soon as the delay of that duration or more is displayed on monitors, the customer is eligible for the SmartBenefits payment. And if the delay is shortened, the customer still receives the payment. (On the other hand, if the delay is extended, the customer needs to call or go online to file an additional claim.)

No-Receipt Claims

Other quick, fixed payment claims can be filed for other forms of delays or for baggage delays. SmartBenefits, for example, covers train, ship, or bus travel delays that don’t involve monitored flights. By phone, online, or in the app, travelers just need to show proof of covered delay, such as an email, revised itinerary, or other notification from the travel provider for the fixed benefit payment.

With select travel insurance plans, covered baggage delays of 12 hours or more are eligible for SmartBenefit's fixed payment of $100 per person, per day, without receipts. All that’s needed is the claim form from the airline…and the delivery receipt. If expenses during the delay exceed $100, a claim can be filed with the remaining expenses.

Of course, read your plan carefully or call and ask for clarification about your policy if you have questions.

Many consumers are reluctant to travel because they find planning a vacation too stressful and time-consuming.

Vacation Confidence Index

And about those wacky studies. The Vacation Confidence Index has been conducted each summer since 2009 by national polling firm Ipsos Public Affairs on behalf of Allianz Global Assistance USA. A vacation is defined as a leisure trip of at least a week to a place that is 100 miles or more from home. But you'll see below that ‘micro-cations' are increasingly popular as travelers juggle time and finances to participate in more classic holidays.

Here are a few of the reports released recently.

1. Vacation Time vs. Pay

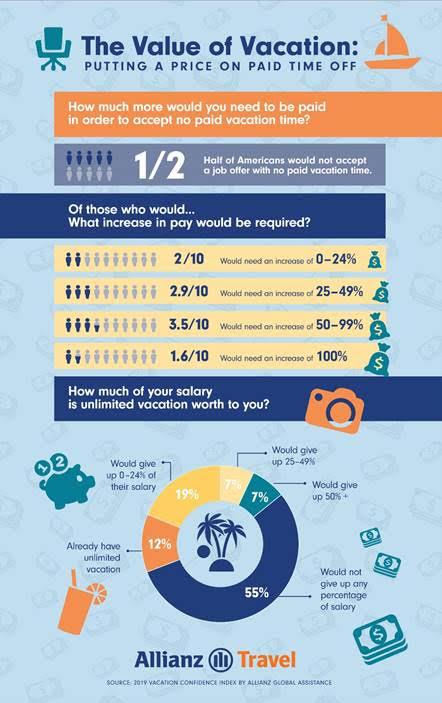

Half of Americans would not accept a job with no paid vacation time. (Sorry, but in my book this also means half would accept a job with no paid vacation.) The average employee takes only 41 percent of their vacation days.

2. Time since last vacation

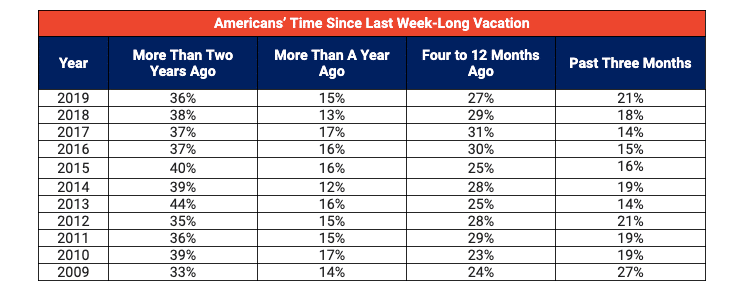

Over a third (36 percent) of Americans took their last vacation more than two years ago, and over half (51 percent) have not vacationed in more than a year, according to the 2019 Vacation Confidence Index. Reasons for not taking vacations include financial concerns and professional and personal obligations. Ten percent of those not confident in taking a vacation “find planning a vacation too stressful and time-consuming.”

3. Increase in Micro-Vacations

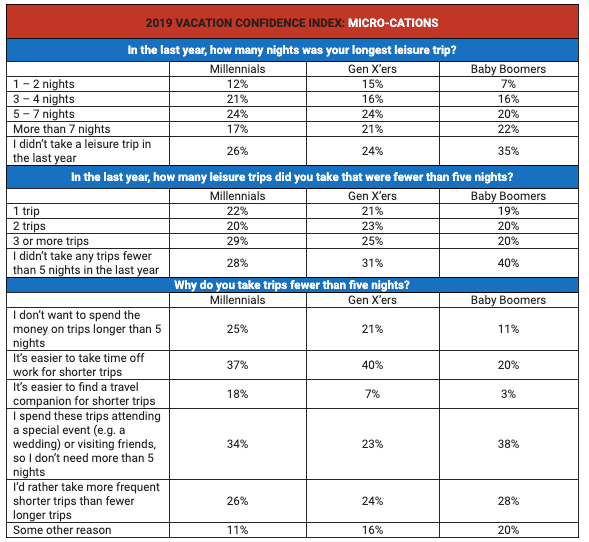

One way travelers, especially younger travelers, are managing their vacation time is by opting for trips of four nights or fewer.

4. Travel Spending

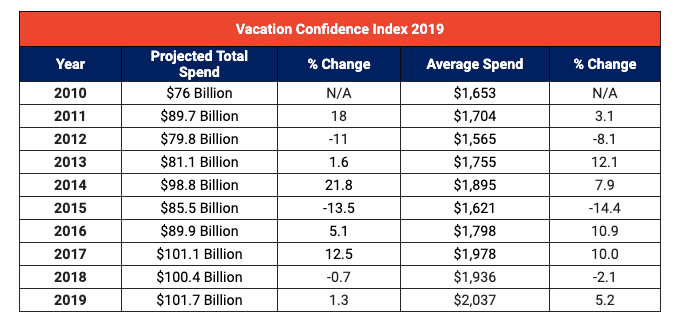

Americans’ average anticipated spend on vacations this summer is $2,037, topping $2,000 for the first time since 2010 when the survey started tracking spending, and marking a 5.2% increase over last year. Some of this is due to price increases. According to the Global Business Travel Association and Carlson Family Foundation, travel prices are expected to rise sharply in 2019 due to a growing global economy and rising oil prices.

Note: as ambassadors for Allianz Travel, we share some of their research and write about our own experiences with travel and travel insurance. Our travel insurance content is not reviewed or approved by Allianz. As an Allianz affiliate, Travel Past 50 may receive a small commission on purchases made through our links, at no additional cost to you. Check out the Allianz Travel options that suit your needs.

Read our story about how to buy travel insurance as you're booking your trip.

The SmartBenefit program sounds interesting — different than other plans I’ve seen. I’ll take a closer look at it for future travels. Interesting statistics — some quite surprising.

I’m amazed that only 41% of American use their paid vacation time. I’m hope our posts and those from other bloggers show that it travel doesn’t have to be expensive and stressful!

I can’t imagine not using my vacation time and find it interesting that so many in the US could pass up both the benefit and the opportunities it affords. Europeans have the right idea. . .when everything shuts down in the big cities and they head out on . . .vacation!!

Agreed. When everyone takes the same month off, it must ease some of the stress of missing out on work, since no one is there!

Really interesting stats and information – that I wouldn’t really have thought about otherwise. I think our travel insurance is backed by Allianz – we’ve always found them to be good.

Thanks, Jo. After traveling so much, it is a good reminder for me that so many people see only the barriers and none of the rewards. I’ll hate reading–and won’t publish–the many travel stories inciting fear. Travel on!

It is so unpleasant when everything goes wrong. Recently I spent the night at Dunkin’ Donuts in Newark airport. It was a terrible experience that put me there. I wonder if the SmartBenefit program could have helped me. I’m not sure, but maybe.

Yikes, that sounds bad under any circumstances. Instant compensation might have eased your misery!

Travel Insurance is so very important. Allianz is my insurance of choice. I’ve had to file twice, and they were great to work with.

Glad to hear it, Patti. It’s great to have a silver lining story to go with the reality of travel mishaps! Thanks.